IRDept – Your One-Stop IR Shop for Effortless and Cost Effective ESG Compliance

HKEX Compliance Effective on July 1, 2020

Effective on 1 July, 2020, all HKEX listed companies need to comply with new ESG guidelines (Environment, Social and Governance) and related Listing Rules. Key changes include:

- Introducing mandatory disclosure requirements to include:

- a board statement setting out the board’s consideration of ESG matters;

- application of Reporting Principles “materiality”, “quantitative” and “consistency”; and

- explanation of reporting boundaries of ESG reports;

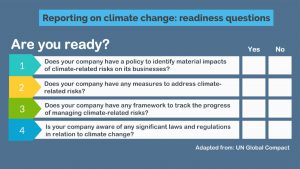

- Requiring disclosure of significant climate-related issues which have impacted and may impact the issuer;

- Amending the “Environmental” key performance indicators (KPIs) to require disclosure of relevant targets;

- Upgradingthe disclosure obligation of all “Social” KPIs to “comply or explain”; and

- Shortening the deadline for publication of ESG reports to within five months after the financial year-end.

Key listing rules amendments include:

| LR 13.91 |

|

|

| Appendix 27 | Reporting Principles

11. The following Reporting Principles underpin the preparation of an ESG report, informing the content of the report and how information is presented. An issuer should follow these Reporting Principles in the preparation of an ESG report:

(1) Materiality: The threshold at which ESG issues determined by the board are sufficiently important to investors and other stakeholders that they should be reported.

(2) Quantitative: KPIs in respect of historical data need to be measurable. The issuer should set targets (which may be actual numerical figures or directional, forward-looking statements) to reduce a particular impact. In this way the effectiveness of ESG policies and management systems can be evaluated and validated. Quantitative information should be accompanied by a narrative, explaining its purpose, impacts, and giving comparative data where appropriate. (3) Balance: The ESG report should provide an unbiased picture of the issuer’s performance. The report should avoid selections, omissions, or presentation formats that may inappropriately influence a decision or judgment by the report reader. (4) Consistency: The issuer should use consistent methodologies to allow for meaningful comparisons of ESG data over time.

|

For further details, the ESG Consultation Conclusions, respondents’ submissions, amendments to the Main Board Listing Rules and amendments to the GEM Listing Rules are available on the HKEX website.

Why IRDept’s ESG Reporting Solution?

IRDept offers one-stop IR solution so that you can focus on your core business. Together with other IR packaged solutions, we help you comply with the new ESG requirements effortlessly and cost effectively

- ESG benchmarking

- ESG-based IR and branding

- ESG governance

- ESG risk management

- ESG report publishing automation

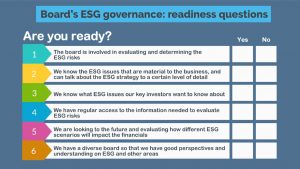

HKEX has laid out a seven-part framework for Board’s ESG oversight, based on which we can tailor a program that fits your ESG strategy and roadmap, from starter package focused on basic compliance to advanced package leveraging ESG to enrich your IR and branding.

Our professional services cover broad spectrum of subject areas specified in HKEX’s ESG Guidelines:

| Subject Area | Aspects |

| A. Environmental | A1. Emissions |

| A2. Use of Resources | |

| A3. The Environment and Natural Resources | |

| A4. Climate Change | |

| B. Social | B1. Employment |

| B2. Health and Safety | |

| B3. Development and Training | |

| B4. Labour Standards | |

| B5. Supply Chain Management | |

| B6. Product Responsibility | |

| B7. Anti-Corruption | |

| B8. Community Investment |

ESG reporting clients our team has helped: